The term private equity refers to an equity investment in non-listed companies. These investments are regularly held through an investment in private equity funds. These identify companies, carry the interests of their investors, and manage the eventual sale of the participations.

The primary focus of private equity funds is a medium to long-term growth of the value of their investments, as returns to their investors usually materialize only upon exit of their shareholdings. Normally, portfolio companies do not distribute profits, as free cash flows are used for debt repayments and strategic investments.

Private equity funds have historically generated consistent excess returns compared to public equity investments. Majority ownership enables active influence over strategy and management team composition. As temporary owners, private equity funds aim for the rapid realization of value creation potential. Additionally, personal investment at all levels (both fund and company management) ensures alignment of interests with fund investors.

Institutional investment funds are the primary investors in private equity funds. For decades, they have valued the superior returns compared to traditional asset classes such as equities, bonds, gold, and real estate, leading them to allocate significant capital to the asset class.

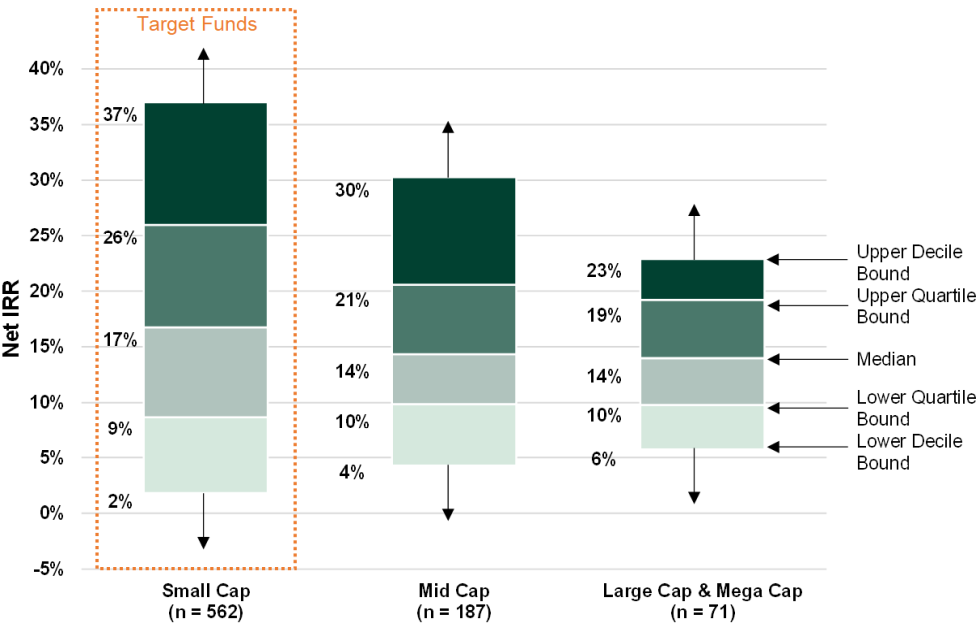

Performance of Different Asset Classes

Source: Preqin, FactSet, S&P Cap IQ – 2014 until 2024.

Private equity investments represent a long-term asset class that is not publicly traded and therefore only partially liquid. As a result, investors typically allocate only 10-20% of their portfolios to private equity.