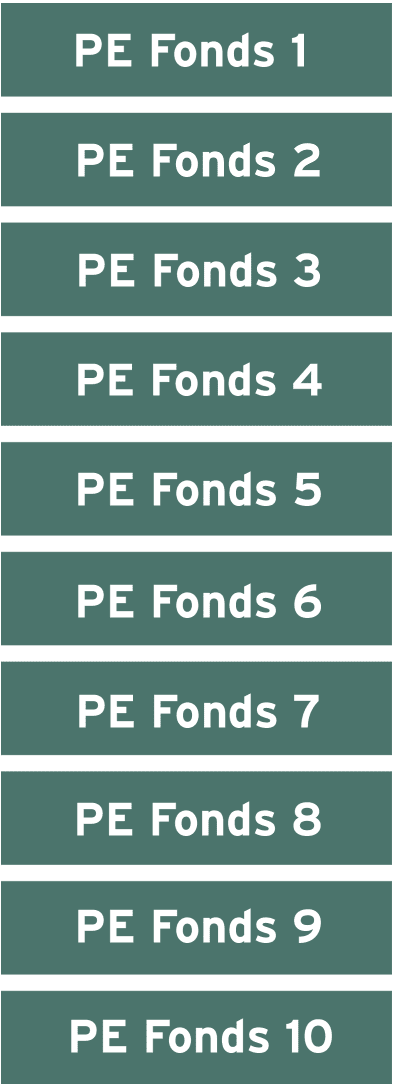

The main investment strategy of RCF01 are investments in 8-12 European Small Cap private equity funds (so-called target funds).

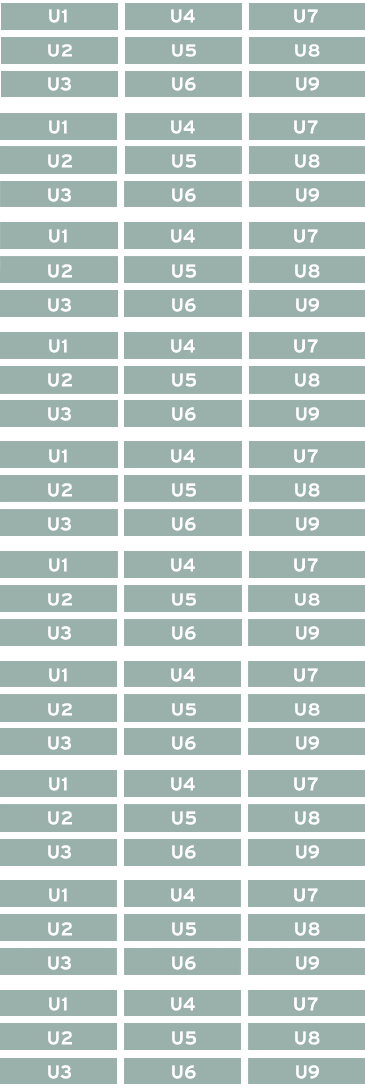

These private equity funds regularly acquire majority stakes in smaller companies with a buyout or growth strategy. Typically, the enterprise values of these companies range from 10-250m EUR. This allows investors to participate in established growth companies that, due to their size and market position, present above-average development prospects. Often, selected fund managers apply buy-and-build strategies to create larger companies from smaller entities.

Growth

The minimum commitment is 200,000 EUR. This amount will be called in several tranches over an anticipated period of

3-4 years. Subsequently, distributions from target funds will lead to distributions to the RCF01 investors until the end of the fund term. RCF01 is only available for semi-professional or professional investors.