Private equity funds are closed-end fund investments. Unlike public stock investments, private equity funds are only open for new investors when they raise a new fund

(every 3-5 years).

The market is also non-transparent as the performance of smaller private equity funds is regularly not available in the public domain or through databases. To assess the quality and performance, a regular engagement with these fund managers is necessary. For an investment recommendation, we only consider target funds where we

- expect persistent overperformance

- find a team with long-term and relevant experience

- a high alignment between fund managers and their investors

- identify a fund manager with sustainable unique selling points

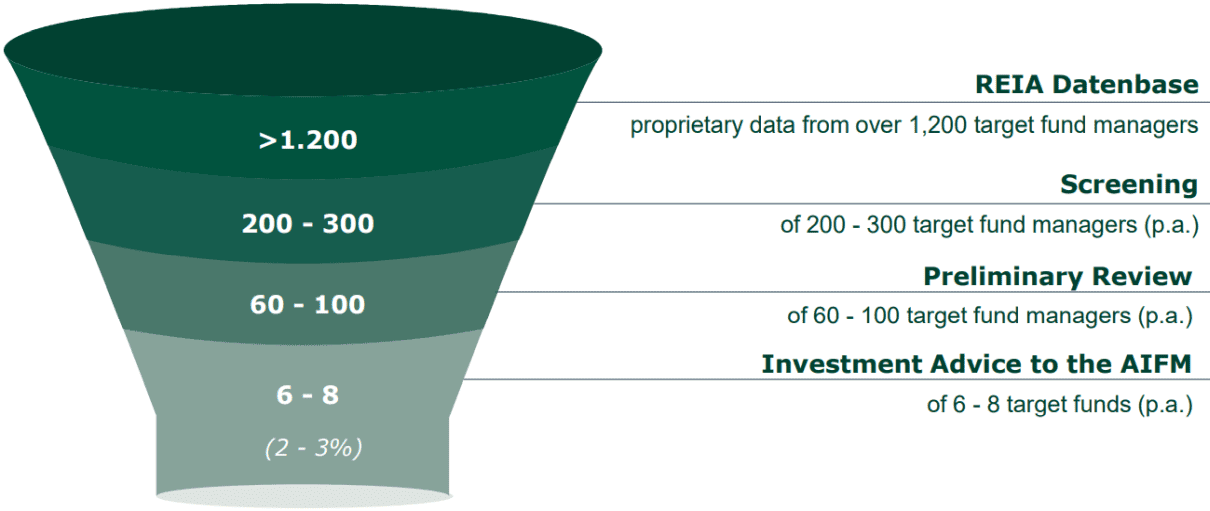

Selected target fund investments

reviewed by experienced industry insiders

Source: Own illustration